Climate Change Impact: Soaring Home Insurance Costs Nationwide

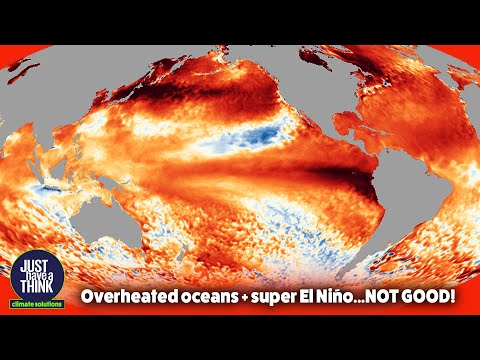

Your homeowners' insurance bill may serve as a warning sign of the growing impact of climate change on your finances. With the average cost of coverage soaring to $1,900 per year nationwide, and even higher in climate-vulnerable regions like New Orleans and Miami, the rising expenses could just be the beginning. Climate risk is forcing insurers to reevaluate their pricing models, leading to a 12% jump in premiums across the United States in 2022, and further increases are expected. As insurers struggle with unpredictable losses, some have withdrawn from risky areas, leaving state-backed insurance plans to deal with the aftermath.

While housing markets have largely disregarded these exposures, the looming threat of climate change could erode property values and increase financial burdens on policyholders everywhere. This pressing situation calls for immediate action to address the risks posed by climate change. The government must ensure that public and private insurers are adequately capitalized to withstand significant climate-related risks. Stress tests could be instituted to assess market resilience against the impacts of climate change, helping insurers prepare for potentially devastating events. As unpredictable losses and climate-induced disasters become more common, having robust financial buffers will be crucial to protecting policyholders and stabilizing the insurance industry.

By taking proactive measures, we can mitigate the long-term effects of climate change on homeowners' insurance, safeguarding both individuals and the broader economy from its far-reaching consequences.

SOURCE: Read the full article in The New York Times

How Climate Change is causing the prices of Chocolate from Ecuador to rise

How Climate Change is causing the prices of Chocolate from Ecuador to rise

How Climate Change is causing the prices of Wine from British Columbia to rise

How Climate Change is causing the prices of Wine from British Columbia to rise

How Climate Change is causing the prices of Olive Oil produced in Spain to rise

How Climate Change is causing the prices of Olive Oil produced in Spain to rise

How Climate Change is threatening the Cheese industry in France leading to spikes in price world wide

How Climate Change is threatening the Cheese industry in France leading to spikes in price world wide

In Georgia, record droughts are causing Peach crops to fail and increase the prices we pay at the grocery store.

In Georgia, record droughts are causing Peach crops to fail and increase the prices we pay at the grocery store.

A rise in rates, pauses, and heavy restrictions for home insurance policies amidst disasters are significantly changing the insurance landscape for homeowners.

A rise in rates, pauses, and heavy restrictions for home insurance policies amidst disasters are significantly changing the insurance landscape for homeowners.